How GenAI is Reshaping the Insurance Value Chain

From AI-driven underwriting to streamlined claims processes, generative AI is transforming the insurance industry’s operational capabilities, offering unprecedented speed, accuracy, and scale

The insurance industry is undergoing a fundamental shift driven by the rapid adoption of generative AI (genAI) technologies. As companies face growing pressure to optimize operations, reduce costs, and offer more personalized services, the potential of genAI is becoming a key differentiator in a highly competitive market. Industry leaders like AIG have already set the tone, with CEO Peter Zaffino emphasizing AI’s role in "redesigning and refining the end-to-end underwriting workflow" during an earnings call in 2024.

But how exactly is genAI reshaping the insurance value chain, and what opportunities does it present for insurers to remain at the cutting edge?

The Insurance Value Chain and GenAI Integration

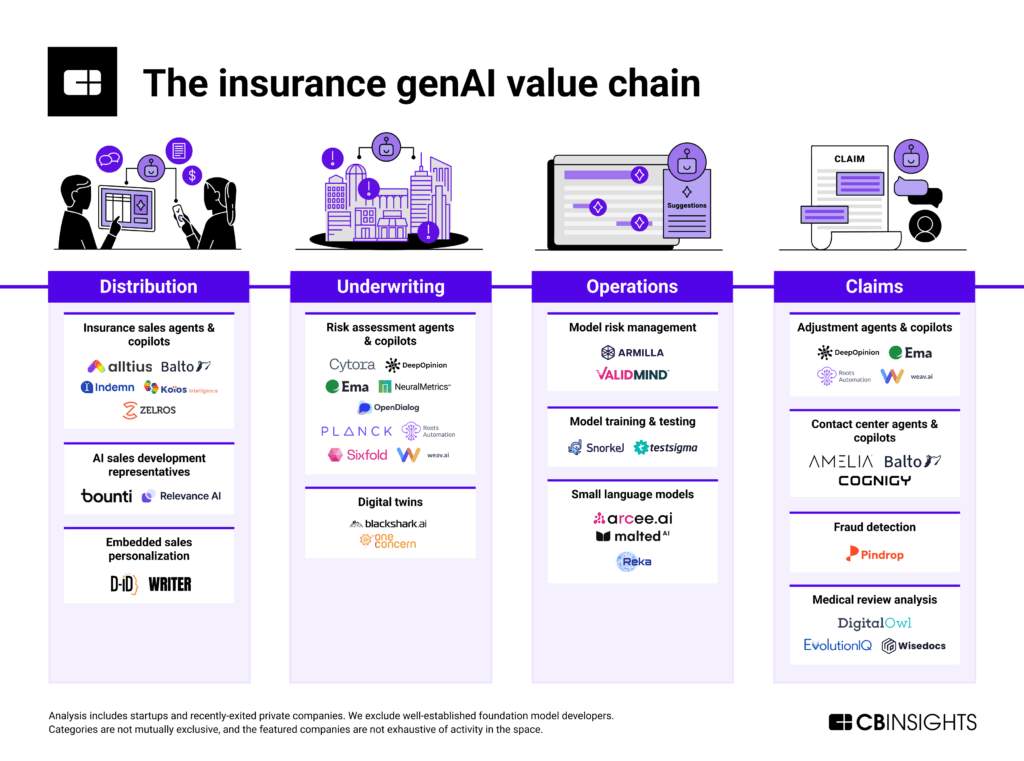

Insurance involves multiple stages—distribution, underwriting, operations, and claims management. Each area offers the potential for genAI to improve efficiency and decision-making, leading to faster response times and better customer experiences. Below are some of the most impactful ways genAI is transforming the value chain:

1. Distribution

Companies must assess risk profiles in insurance distribution and present suitable products to potential customers. GenAI can enhance these processes by analyzing customer behaviour, demographics, and historical data. AI-powered agents can recommend tailored policies to clients, improving customer satisfaction and higher conversion rates. Additionally, genAI can automate customer interactions via chatbots or virtual assistants, creating a seamless experience in policy acquisition and customer service.

Relevance for insurers: Automating front-end processes with AI-powered tools enhances the customer journey while lowering operational costs, allowing insurers to scale their offerings without sacrificing quality.

2. Underwriting

Underwriting, assessing risk and determining policy terms has traditionally been labour-intensive and time-consuming. GenAI changes this by leveraging vast amounts of unstructured data, including client information, historical claims, and industry trends, to assess risk profiles more accurately. By integrating AI models, insurers can process applications faster and more precisely.

AI systems also continuously improve as they learn from historical data and new events, meaning they can refine underwriting models over time to become even more predictive and efficient.

Relevance for insurers: Speed and accuracy in underwriting can lead to better quote-to-bind ratios, which means more policies issued with fewer delays, reducing costs and enhancing competitiveness.

3. Operations

Insurance back-office operations, including policy administration, fraud detection, and compliance, can all benefit from genAI integration. Digital twins—virtual models of real-world processes—can simulate operations, predict bottlenecks, and suggest optimizations to improve overall efficiency. Small language models (SLMs) can also process and analyze unstructured documents like contracts, emails, and customer queries, reducing manual workload and enhancing accuracy.

For example, fraud detection systems built with AI can identify suspicious patterns in real time, saving companies millions in fraudulent claims payouts.

Relevance for insurers: By automating routine tasks and enhancing operational efficiency, companies can significantly reduce overhead costs while maintaining strict compliance and improving service quality.

4. Claims

Claim processing is often viewed as the most crucial interaction between insurers and policyholders. Delays or errors in this stage can severely impact customer trust. GenAI offers solutions by automating the claims workflow, from document analysis to decision-making support. AI-powered systems can analyze claims, detect potential fraud, and even provide adjusters with real-time assistance.

Moreover, AI can provide dynamic support for human adjusters, offering real-time suggestions and insights, thus speeding up the process and ensuring accuracy.

Relevance for insurers: Enhanced claims processing leads to better customer retention and trust while reducing the administrative burden on human adjusters. Automated, AI-driven claims workflows can minimize errors and improve response times, resulting in a more resilient business.

Source: CB Insights

Why GenAI is a Game-Changer for the Insurance Industry

The insurance sector is built on data—whether it’s policyholder information, claims histories, or risk profiles. However, much of this data is unstructured, making it challenging to analyze and act upon. GenAI excels in processing and making sense of such data, providing insurers with deeper insights into customer behaviours and risk factors.

This ability to handle vast datasets also allows insurers to predict trends and anomalies more accurately, resulting in more informed decision-making. As insurers seek ways to optimize processes and create value, the power of genAI becomes critical in driving operational speed and precision.

The Role of Startups in GenAI Insurance Innovation

Startups are vital in pushing the boundaries of genAI within insurance. They are developing niche applications explicitly tailored to the industry, offering products such as AI-powered claims systems, predictive analytics platforms for underwriting, and conversational AI agents. These innovations, often in partnership with established insurers, are speeding up the adoption of AI in a traditionally cautious sector.

For instance, insurance companies already provide AI solutions that analyze customer data to deliver personalized policies or detect fraudulent claims before processing. Strategic investments from insurance companies into these startups are accelerating the deployment of AI-driven solutions across the value chain.

Business Impact: Use Cases and Industry Examples

Real-time Risk Assessment

GenAI systems can analyze a policyholder’s risk profile in real time, allowing insurers to adjust policy terms dynamically based on new data. This has profound implications for industries like health insurance, where lifestyle changes or medical advancements can significantly alter an individual’s risk profile.

Personalized Customer Engagement

By integrating genAI into customer service, insurance companies can create highly personalized experiences. For example, AI-driven chatbots can provide customers with policy recommendations or address queries 24/7, improving overall satisfaction while reducing human workload.

Faster Fraud Detection

AI systems can sift through claims data, detecting unusual patterns indicative of fraud. This capability saves insurers money and helps ensure that legitimate claims are processed more quickly, improving customer relations.

The Future of Insurance in a GenAI-Powered World

As genAI technology advances, the insurance industry will see more use cases emerge across all facets of the value chain. From predictive analytics in underwriting to personalized, AI-powered customer interactions, the role of generative AI will only grow more significant.

For insurers, the choice is clear: embrace the transformative potential of genAI or risk being left behind by more agile competitors already leveraging AI to drive innovation and streamline operations. The future of insurance is not just digital; it’s intelligent.