Europe’s SaaS Surge Goes AI-Native

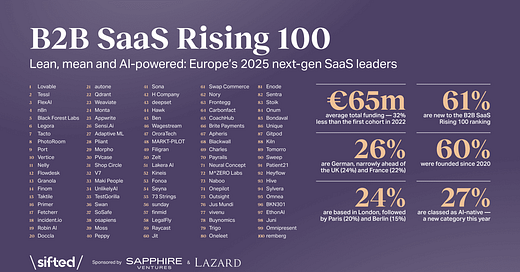

Europe’s 2025 B2B SaaS Rising 100, compiled by Sifted, throws a sharp spotlight on how artificial intelligence is reshaping the continent’s software-as-a-service landscape. This year’s data reveal not just the growing footprint of AI-powered tools but also the ascendancy of startups built from the ground up around machine learning, large language models, and other AI innovations.

AI-Native Startups: A New Category on the Rise

27 per cent of this year’s cohort are classified as AI-native — companies that launched with AI at their core rather than retrofitting it later.

AI-native firms represent a new classification in the Rising 100, underscoring the central role machine intelligence plays in innovative SaaS propositions.

Why it matters: Embedding AI from day one accelerates experimentation with novel architectures (e.g., transformer-based features), enables rapid iteration on data-driven workflows, and often attracts a premium from Series A investors seeking differentiated, defensible technology stacks.

Top of the Table Goes to the AI Pioneers

Among the top ten spots, all but one are AI-centric ventures:

Lovable (#1) – generative AI platform for customer support

Tessl (#2) – automated AI models for IoT data

FlexAI (#3) – no-code AI templates for marketers

n8n (#4) – workflow automation extended with AI nodes

Black Forest Labs (#5) – AI-driven digital twins for manufacturing

Legora (#6) – intelligent knowledge-base assistant

Tacto (#7) – AI tool for sales pipeline optimisation

PhotoRoom (#8) – image-editing powered by deep learning

Port (#9) – AI-first data integration platform

Vertice (#10) – semantic search built on vector embeddings

Their lead positions underscore how embedding machine-learning pipelines and generative models into core product functionality can drive both explosive user-growth curves and investor enthusiasm.

Funding, Founding Dates and the Fast-Moving AI Wave

€65 million is the average total funding raised by these Rising 100 companies — about one-third less than the inaugural 2022 cohort, suggesting more capital-efficient growth models, often achieved by leveraging open-source AI stacks and cloud-native services.

A striking 60 per cent of all listed startups were founded since 2020, meaning their entire formative development period coincided with the latest AI renaissance.

61 per cent of the list represents newcomers to the Rising 100 ranking, signalling relentless churn and the constant emergence of fresh AI-infused propositions.

What This Means for Europe’s Tech Ecosystem

AI first, SaaS second: Companies that built machine intelligence into their DNA are leap-frogging incumbents that tack on AI as an afterthought.

Country dynamics: For the first time, Germany (26 companies) surpasses the UK (24) in representation — a sign of maturing AI-focused venture networks in Berlin, Munich, and beyond.

Geography of innovation: While London remains top with 24 per cent of the list, Paris (20 per cent) and Berlin (15 per cent) round out the trio of Europe’s fastest-growing SaaS hubs, driven in large part by AI labs and university spin-offs.

As Europe’s seed-to-Series A pipeline increasingly prizes AI-first roadmaps, the next Rising 100 is likely to see even more radical applications of machine intelligence — from automated drug-discovery pipelines and adaptive cybersecurity suites to AI-augmented design tools and beyond. The 2025 rankings confirm that the continent’s SaaS future is unquestionably, irreversibly AI-powered.